Hello! Welcome to the fourth and final installment of Need to Know Crypto Edition, ahead of the launch of a new weekly “Distributed Ledger” crypto newsletter, starting next month. I'm Frances Yue, a crypto reporter at MarketWatch, and I'll walk you through the latest and greatest in digital assets this week so far.

Another thing, MarketWatch and Barron's are bringing together the most influential figures in crypto to help identify the opportunities and risks that lie ahead in digital assets on October 27 and November 3. Register now!

Crypto in an instant

We have witnessed two historic moments for bitcoin

BTCUSD

this week. ProShares Bitcoin Strategy ETF

Bit,

The first exchange-traded fund linked to bitcoins in the US, made its debut on Tuesday. After that, bitcoin hit an all-time high on Wednesday, trading close to $ 67,000, beating its previous record of $ 64,889 in April, according to data from CoinDesk. At noon on Friday, bitcoin was up 5.1% for the past seven days and 48.9% for the past 30 days.

Ether

ETHUSD

It also approached its all-time high, trading at $ 4,370 on Thursday, slightly below its all-time high of $ 4,379.11 in May.

Cryptographic metrics

| Biggest winners | Price | % Return 7 days |

| United Nations |

$ 28.3 |

70.6% |

| THORChain |

$ 10.9 |

38.9% |

| Huobi Token |

$ 10.2 |

33.6% |

| Ghost |

$ 2.6 |

31.2% |

| Nexus |

23 $ |

30.3% |

| Source: CoinMarketCap.com to October 22 |

| Major declining | Price | % Return 7 days |

| Flow |

$ 13.6 |

-22.8% |

| Telcoin |

$ 0.02 |

-15.9% |

| Celsius |

$ 5 |

-14.2% |

| Perpetual protocol |

$ 16 |

-12.44% |

| dYdX |

$ 19.9 |

-12.3% |

| Source: CoinMarketCap.com to October 22 |

A grayscale bitcoin ETF?

On the same day as BITO's debut, the digital asset manager Grayscale filed to rotate Grayscale Bitcoin Trust

GBTC,

the world's largest bitcoin fund, to a spot bitcoin ETF, which is different from the SEC-approved ProShares bitcoin futures ETF.

The grayscale has a good reason. A conversion to an ETF from its current trust structure will help mitigate GBTC's long-standing problem: stocks haven't always aligned with the bitcoin price. GBTC has been trading at a discount to its NAV, or its underlying bitcoin holdings since February, as investors turn to alternatives in the stock market to gain exposure in bitcoin, such as bitcoin ETFs in Canada.

Monday when cryptocurrency market celebrated SEC approval for BITO, GBTC's discount to its net asset value was widened to 20.5%.

Unlike closed funds, an ETF allows designated organizations to create and redeem shares of the ETF to keep their price in line with the NAV. So the GBTC discount will no longer be a problem, if your plan gets regulatory go-ahead.

Grayscale's conversion efforts have been in the works for years; He filed an application for a bitcoin ETF in 2016 just to withdraw it, and has done so repeatedly. expressed his commitment to change its fund structure to maintain its dominant position as the largest crypto asset manager.

"At Grayscale, we believe that if regulators are comfortable with ETFs holding futures on a given asset, they should also be comfortable with ETFs that offer spot price exposure for that same asset," Dave LaValle, Global Head of ETFs at Grayscale Investments said Tuesday.

However, some analysts argue that a spot bitcoin ETF may still be a long way off.

Bitcoin futures have been regulated by the Commodity Futures Trading Commission since 2018, while such products are traded on the Chicago Mercantile Exchange, one of the largest derivatives exchanges in the world. “That’s what made the SEC comfortable in allowing [bitcoin futures ETF] product. You don't see that with the underlying [physical bitcoin]”Carlo di Florio, global director of services for the compliance advisor ACA Group and former director of the SEC, told MarketWatch in a telephone interview.

“I think companies will need to do a lot more work to design products that provide investor protection and market integrity assurance before we see the green light. [bitcoin] place [ETFs]"Said Florio.

Ether futures ETFs, which are also traded on CME, could be more predictable than spot bitcoin ETFs, according to di Florio. "Because they are future," said di Florio. “And it follows the same path that made the SEC comfortable with the Bitcoin futures ETF. Therefore, they are likely to benefit from the same regulatory comfort. "

In August, VanEck and ProShares both abandoned their applications for Ether Futures ETFs two days after they applied. Some analysts suspected that the SEC reached out to both issuers and indicated that ether-linked ETFs would likely not be approved, at least not before bitcoin-linked ETFs get the go-ahead.

Darius Sit, a managing partner at digital asset trading firm QCP Capital, echoed Di Florio's point, saying that an ether futures ETF could be approved before the middle of next year.

Three is a crowd?

VanEck is slated to be the next funder to launch a bitcoin futures ETF. It will be the third futures-linked bitcoin ETF since BITO made its debut last Tuesday.

The VanEck Bitcoin Strategy ETF is expected to begin trading on October 25 (although that could change) and will be listed on the Cboe Global Markets BZX Exchange under the ticker symbol "XBTF," according to a post-term filing with the SEC. The expense ratio for the ETF is 0.65%, which means that an investor would pay annual fees of $ 6.50 for every $ 1,000 invested, which is lower than the expense ratio for the Valkyrie Bitcoin strategy. that started on friday, and ProShares, which have a 0.95% expense ratio.

Crypto leverage

After bitcoin last hit a record high in April, the crypto's price dropped by more than half in about a month. The drop was exacerbated by the amount of leverage in the market, as "a ton of the new leveraged longs were liquidated," Sam Trabucco, CEO of quantitative cryptocurrency trading company Alameda Research. wrote On twitter.

And this time? Although Trabucco said that it is difficult to predict in which direction the price of bitcoin will go, he wrote that "I think the selloffs are FINALLY starting to be less important."

The aggregate open interest of bitcoin futures, which refers to the number of futures contracts in circulation, is about 20% lower than in April, according to data analytics firm Skew. Futures are derivative contracts that allow investors to speculate on the price movements of an underlying asset, often using leverage.

"That means the potential for a large liquidation-driven drawdown is MUCH less," Trabucco wrote. "I think there is less (but still not zero) chance that a move down is really inordinate."

"And the same is true for a bullish move, roughly," Trabucco noted.

The $ 29,000 Tungsten NFT?

Tungsten is associated with being the filament in incandescent light bulbs, which could make it quite an anachronistic element. object of desire in the digital community more familiar with LED lighting sources or light-emitting diodes.

However, tungsten, also the second hardest substance after diamonds and whose high density, corrosion resistant and tensile strength properties, when combined with other elements, make it ideal in the construction of aeronautical components and military weapons, it's the loudest thing in crypto. world outside of virtual assets (and ETFs), right now.

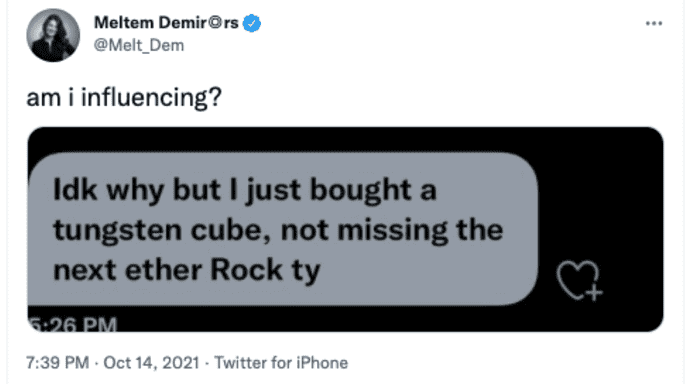

The rabid interest in tungsten has made it a meme both in the real world and on social media platforms like Twitter.

And like most other memes, its origins are difficult to trace, but interest in tungsten, particularly among the crypto Illuminati, has led to a 300% increase in sales of tungsten cubes for manufacturer Midwest Tungsten Service in a week, according to reports.

The appetite for tungsten apparently led Midwest Tungsten Service to auction off a non-expendable token, or NFT, of the 14-inch, 1,784-pound tungsten cube, the largest the manufacturer has ever produced. At the last check, the top bid was well above $ 29,000, with a few days remaining in the auction. The winning NFT bidder will be entitled to “one cube viewing / photographing / touching visit per calendar year,” per the description. The cube is stored in Willowbrook, Ill.

In mid October Yahoo! Finance wrote that tungsten cubes have been sold out on Amazon.com and that UK searches for tungsten on Google have skyrocketed 95%.

Crypto companies, funds

In the background space, BITO

Bit

it fell 3.23% on Friday. The highly anticipated ETF closed its first week at $ 39.5, below its opening price on Tuesday at $ 41.9. Valkyrie Bitcoin Strategy

BTF,

The second US bitcoin futures ETF to make its trading debut on Friday, closed its first day down 2.8% at $ 24.3.

Grayscale Bitcoin Trust

GBTC

closed at $ 48.8, with a daily loss of 0.5% and a weekly gain of 2.8%.

In cryptocurrency-related company news, Coinbase shares

CURRENCY

It was up 0.3% to $ 300.8 on Friday and up 7.2% over the past week. MicroStrategy Inc. by Michael Saylor

MSTR

It fell 2.3% to $ 718.5 on Friday. It was down 4.2% during the week.

The mining company Riot Blockchain Inc.

DISTURBANCE

the shares fell 3.9% on Friday to $ 28.5. It was 1.54% more than a week ago. Marathon Digital Holdings Inc. Shares

MARA

it closed at $ 49.5 on Friday, 2.9% less than Thursday's close, but 1.17% more during the week. Another miner, Ebang International Holdings Inc.

EBONY

decreased 3.8% to $ 2.05. It was up 4.1% for the week.

Overstock.com Inc.

OSTK

it was practically flat at $ 80.9 on Friday. It was up 4.2% for the week. Square Inc.

SQ

fell 4.5% to $ 253, with a weekly gain of 1.6%, while Tesla Inc.

TSLA

Share it was up 1.75% to $ 910, posting a 7.9% weekly gain.

fell 1.2% to $ 240, posting a 10.4% weekly loss, while NVIDIA

NVDACorp.

it was up 0.2% to $ 227, contributing to a 4% weekly gain. Advanced Micro Devices Inc.

AMD

It was up 0.4% to $ 120 and posted a 6.9% weekly return.

Must read