Today, approximately $1.96 billion in Bitcoin (BTC) and Ethereum (ETH) options are about to expire, creating significant anticipation in the cryptocurrency market.

Crypto Options Expiring Generally Could Drive Notable Price volatility. Therefore, traders and investors are closely monitoring the development of today's expiration.

Historical Trends Point to Rally as Crypto Options Near Expiration

from today expiring bitcoin options They have a nominal value of 1.27 billion dollars. These 19,712 expiring contracts have a put-to-call ratio of 0.46 and a critical high of $66,500.

In the context of options trading, the maximum pain point represents the price level that causes the maximum financial pain to option holders. Meanwhile, the put-call ratio suggests a prevalence of call options over put options.

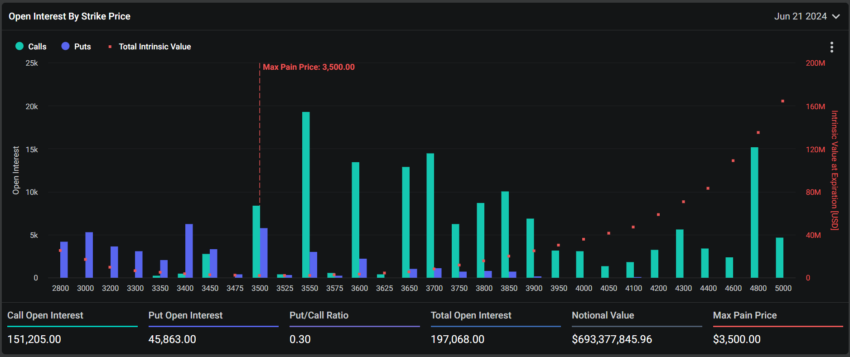

On the other hand, Ethereum has 197,068 contracts with a notional value of $693.37 million. These expiring contracts have a put-to-call ratio of 0.30 and a weak high point of $3,500.

Read more: An Introduction to Crypto Options Trading

Greeks.Live analysts noted an increase in forward options volume, especially block calls. Despite high realized volatility (RV), implied volatility (IV) has remained stable. This situation indicates no big movements in the market Expected before quarterly delivery.

“The trend in the second quarter of this year was weaker, aligning with historical experiences. The third quarter usually has difficulties, and the end of the quarter usually marks the market rebound,” analysts at Greeks.Live. fixed.

Read more: Top 9 Crypto Options Trading Platforms

This week, Bitcoin fluctuated between $64,258 and $66,782, while Ethereum was trading within the range of $3,387 to $3,632. At the time of writing, Bitcoin is trading at $64,924, a decrease of 2.7% over the last seven days. Ethereum is trading at $3,526, up 1.5%.

Although option expirations can cause temporary market disturbances, usually lead to stabilization. Recent analyst opinions highlight historical patterns that traders can consider when strategizing their positions. Ultimately, traders should remain vigilant, analyzing technical indicators and market sentiment to effectively deal with expected volatility.

Disclaimer

In compliance with the Trust project guidelines, BeInCrypto is committed to impartial and transparent reporting. This news article is intended to provide accurate and timely information. However, readers are advised to independently verify facts and consult a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policyand Disclaimers It has been updated.