Bitcoin (BTC) bulls are taking a breather on Saturday, with the cryptocurrency moving sideways just below the yearly highs it posted earlier this year near $38,000, with BTC last changing hands around $37,150 .

The cryptocurrency remains on track to post a strong weekly gain of around 6% as traders digest various bullish narratives such as Optimism over upcoming US Bitcoin ETF spot approvals and a seemingly improving macroeconomic backdrop as investors prepare for the end of the US Federal Reserve's tightening cycle.

This would mark the fourth consecutive week in green for bitcoinand the cryptocurrency is up a whopping 40% from its mid-October lows of $26,000.

In fact, the recent rally puts bitcoin is on track to post its biggest four-week winning streak since January, rising 42% from below $17,000 to nearly $24,000.

Speculation is rife that the US Securities and Exchange Commission (SEC) will approve a batch of Bitcoin spot ETFs starting in January, so the flow of news on this topic will continue to be a big market driver. in the foreseeable future.

But macroeconomic developments are also likely to remain the focus.

Next week the US consumer price index (CPI) and retail sales data for October will be released, which, if it's a week like last latest jobs in USA and manufacturing PMI figurescould add to the bets that the The Fed's tightening cycle is overand that a cycle of rate cuts will soon begin.

This would likely weigh on US government bond yields and support US stock prices and, given the historical positive correlation between US stocks and cryptocurrencies and the negative correlation between US and cryptocurrencies, would likely provide new tailwinds for cryptocurrencies.

Of course, hard data could provoke the opposite reaction, especially given that The Federal Reserve's recent rhetoric remains hawkish.and the bank is apparently trying to convince the market that the door remains open to further interest rate hikes.

Price Prediction: Where Is Bitcoin (BTC) Price Going?

If US inflation data were to surprise to the upside and US retail sales figures were to reject the idea of a US economic slowdown in the fourth quarter after the surprising rise in the third quarter, Bitcoin could risk a short-term correction of up to 5%.

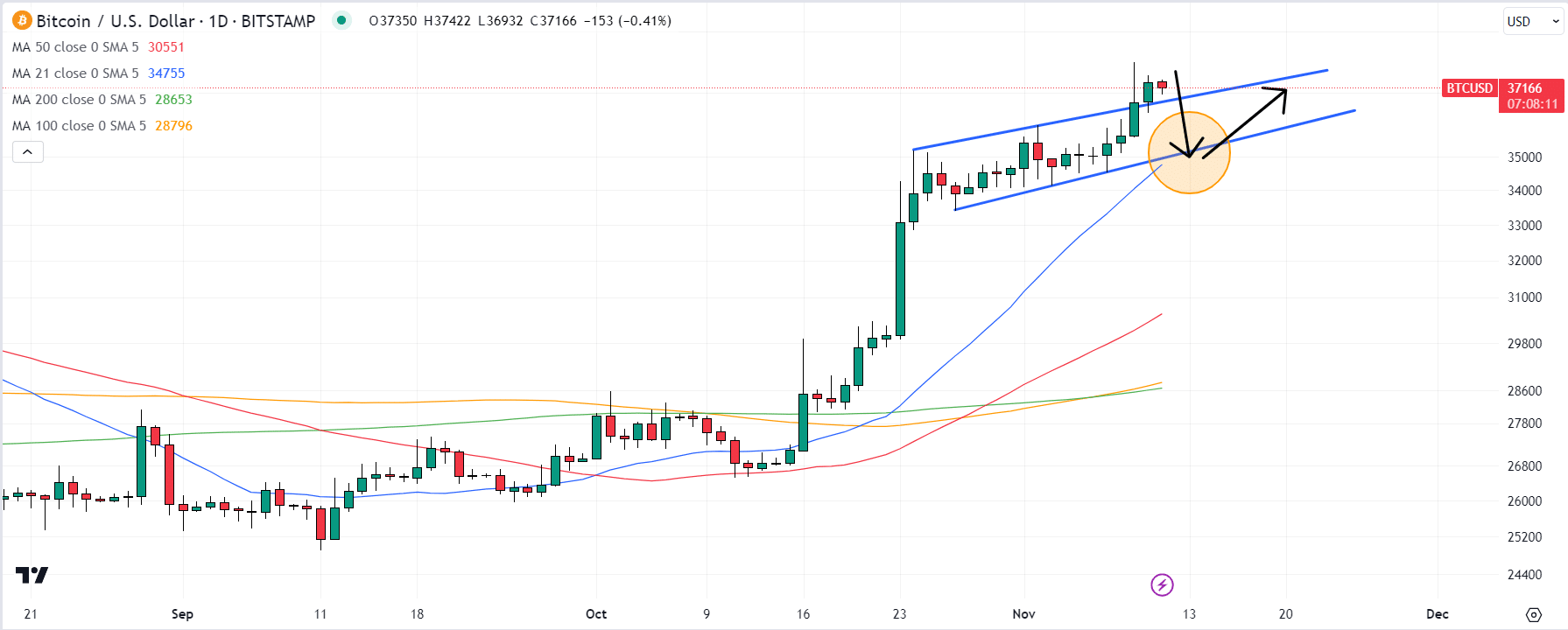

The cryptocurrency recently broke north of a short-term uptrend channel, but could easily return to it and even head back towards the bottom to test its 21DMA, which was last around $34,750.

But it's worth noting that Bitcoin has been remarkably resilient to unfavorable macroeconomic developments in recent months, rallying strongly in October even as US yields hit multi-decade highs and US stocks corrected lower.

Any macro-driven correction could be short-lived, especially with Bitcoin-specific bullish narratives such as upcoming spot ETF approvals and next halving 2024 generating so much emotion.

Price predictions they are expected to remain bullish.

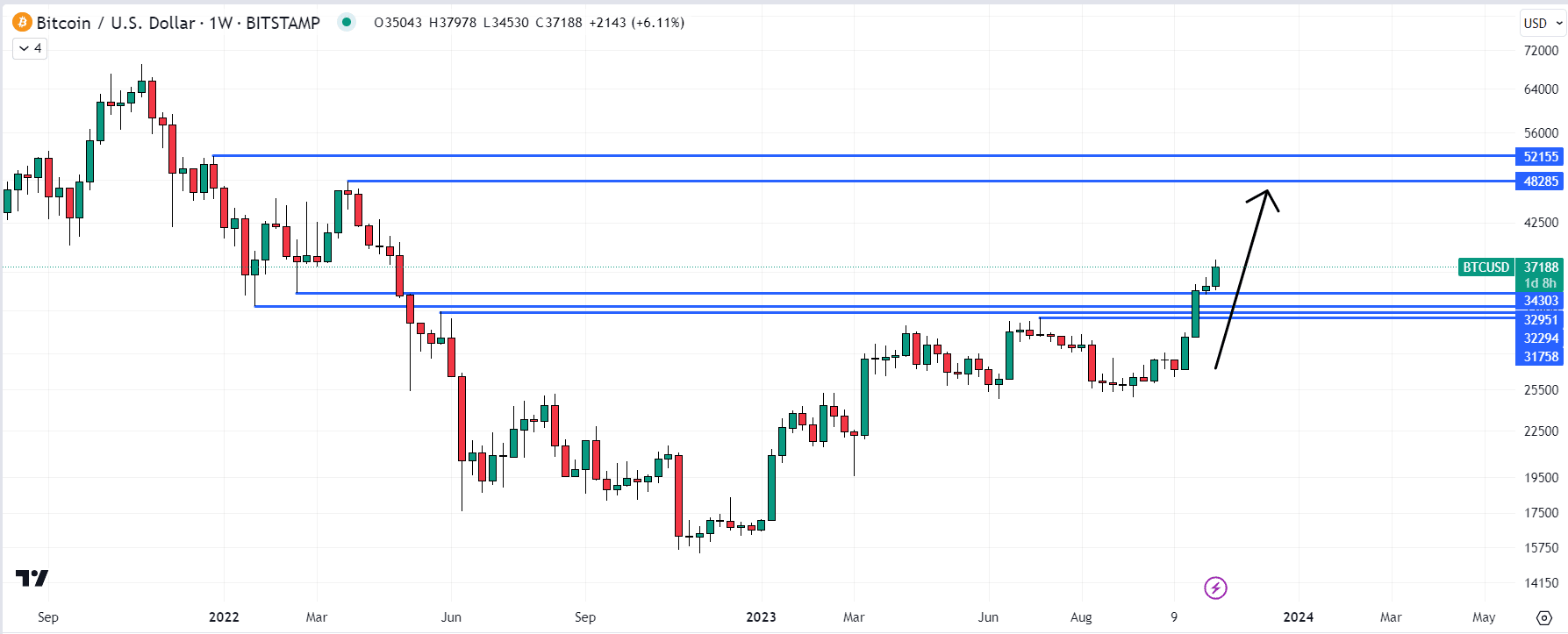

Chart analysis suggests that since Bitcoin has convincingly broken north of the $32,000 to $34,000 resistance zone, a rally towards 2022 highs around $48,000 is likely.

Has the bull market begun?

The definition that investors use when referring to bull markets in the stock market is that when a market rises 20% from a recent low, it has entered a bull market.

According to this definition, the Bitcoin bull market was confirmed as early as the second week of January.

Of course, the prices of cryptocurrencies, including bitcoin, are much more volatile than those of stock indices like the S&P 500.

But with Bitcoin up more than 140% from its 2022 lows of $15,000, it's hard to argue against the idea that Bitcoin isn't in a new bull market.

First, Bitcoin almost perfectly follows the steps of its traditional market cycle, where it suffers an aggressive one-year pullback (as in 2014, 2018 and 2022), and then embarks on a three-year bull market to reach new levels. levels. -time maximums.

It looks like Bitcoin is about a year into its new three-year bull market cycle.

Adding more color to this analysis on Bitcoin's typical market cycle, Trading.biz analyst Cory Mitchell wrote in a note shared with members of the crypto press earlier this week that Bitcoin could enter what he calls a " acceleration phase" as soon as mid-2024.

Bitcoin's "really big gains" historically come a year and a half after the price has bottomed, Mitchell explained, pointing to a pump happening sometime in mid-2024, with BTC last bottoming once in November 2022.

“In 2013, bitcoin was up 1,200% in about 100 days… in 2017, it was up 1,900% in just under a year… at the end of 2020, it was up 400% in about 140 days.”

“Bitcoin bull trends tend to move quickly once they start, often moving hundreds of percent in less than a year,” he noted, predicting that Bitcoin could match its all-time highs of around $69,000 as soon as the middle of next year. anus.