- CORE, WIF and MNT posted the biggest gains of the week.

- KCS, FTM and XMR were the biggest losers of the week.

Last week was marked by an upward trend in the overall crypto market, as the values of several assets increased by double digits.

Over the seven-day period, the global cryptocurrency market capitalization increased by 3.4%. On that note, hHere is AMBCrypto's list of the biggest winners and losers from March 24 to 30.

Biggest winners

Center [CORE]

Center [CORE] is the native token of the Ethereum [ETH] Layer 1 blockchain core compatible with virtual machines (EVM). The altcoin led the cryptocurrency market as the asset with the most gains in the last week.

At the time of publication, it was trading at $1.60, having witnessed a 138% increase in its price over the past seven days.

CORE stock rose 35% in the last 24 hours, extending its weekly gains. During that period, its trading volume increased by 139%. the token It was last traded at the $1.60 price level in May 2023.

dogwifat [WIF]

According to data from CoinMarketCap, solarium [SOL]meme currency based on dog hat [WIF] posted an impressive 90% weekly gain, ranking as the asset with the second-highest gains last week.

On March 30, the meme coin briefly traded above $4.5 to hit an all-time high. Last week's high trading volume caused a significant increase in WIF's market capitalization.

At press time, it stood at $4.2 billion, making it the third-largest meme asset in terms of market capitalization after Dogecoin [DOGE] and Shiba Inu [SHIB].

An assessment of WIF price movements on a daily chart indicated that gains could extend into the new week if bullish sentiment holds.

Key indicators showed that the buying pressure was significantly higher than the token distribution. For example, the WIF Elder-Ray index was positive at the time of this publication and has been since March 28.

This indicator estimates the relationship between the strength of buyers and sellers in the market. When its value is positive and the bars are green, it is a bullish signal, representing an uptick in buying activity.

Confirming the bullish trend, the MACD line of the WIF was above the signal line at the time of this publication. This intersection is a sign of market strength.

It indicates that the short-term moving average has moved above the long-term moving average, presenting an opportunity to buy for profit.

Mantle [MNT]

Mantle [MNT]The native token that powers the Ethereum Layer 2 Mantle scaling solution, witnessed a 60% growth in its price last week.

On March 27, the altcoin price rose to an all-time high of $1.38, pushing its market capitalization above $4 billion.

Last week's rally in the price of MNT was due to the launch of the Mantle Rewards Station. This station allows network users to connect their wallets and lock their MNT in a vault to earn rewards.

At press time, MNT was trading at $1.31, witnessing a 2% drop in trading volume in the last 24 hours.

The biggest losers

KuCoin [KCS]

KuCoin [KCS] is the native token of the troubled KuCoin crypto exchange. Its value dropped 21% in the last seven days, making it the biggest loser of the week.

The drop in the token's value was due to accusations leveled against the founders of the exchange by the Department of Justice (DOJ), accusing them of violating the Bank Secrecy Act and anti-money laundering regulations.

The week also saw a significant increase in outflows from the crypto exchange as investors withdrew their holdings from the platform.

At press time, KCS was trading at $11.21. While its price is up 3% in the last 24 hours, trading volume during the same period is down 51%.

This created a bearish divergence, hinting at a possible drop in the token's value in the short term.

Ghost [FTM]

Ghost [FTM]the native utility token that powers the entire Fantom blockchain ecosystem, ranked as the asset with the second highest losses over the past week.

At press time, the token was trading at $0.96, recording a 9% drop in price during the analyzed period.

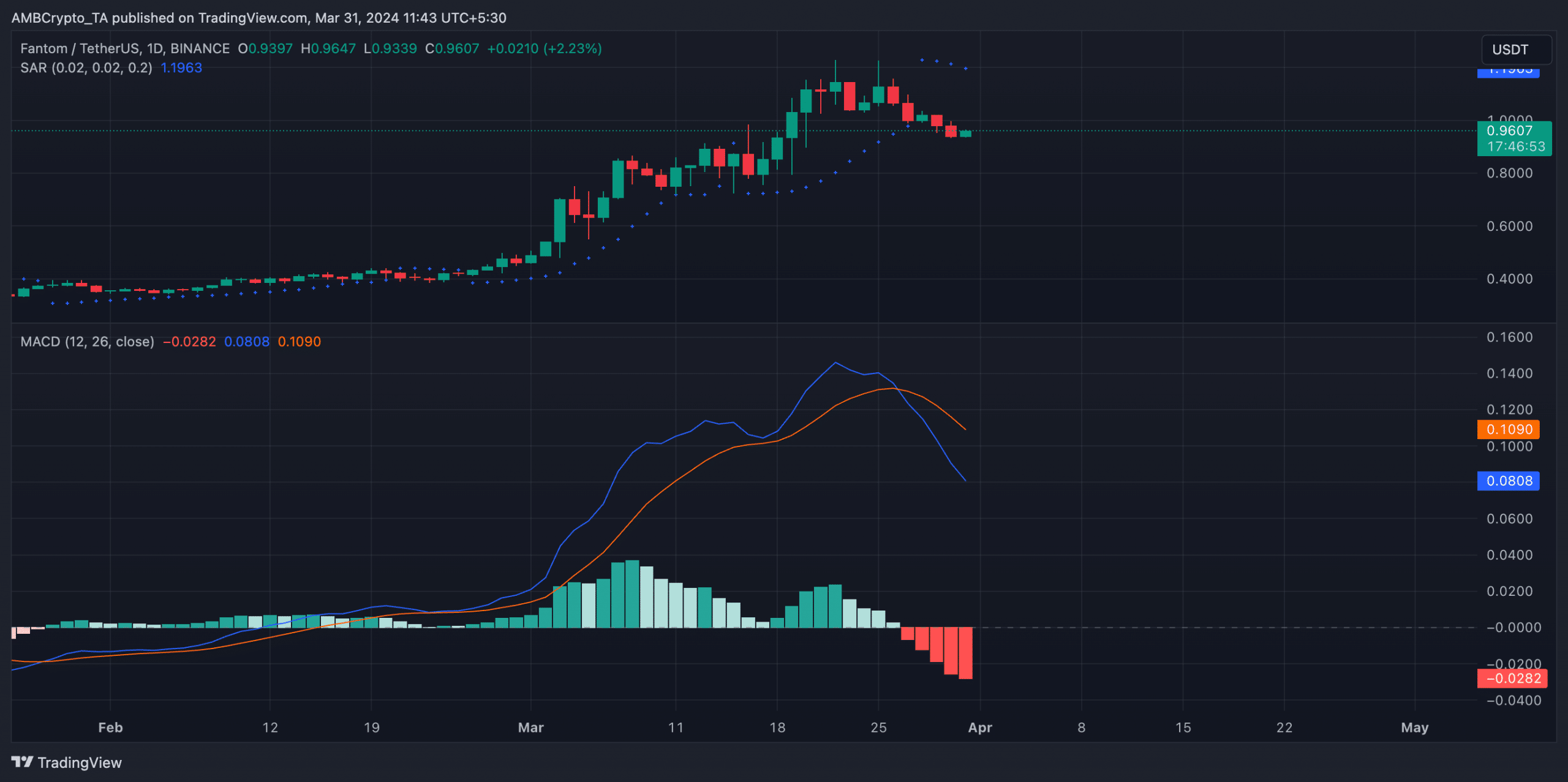

The coin's Parabolic SAR and Moving Average Convergence/Divergence (MACD) indicators observed on a 1-day price chart confirmed the bearish trend in the FTM market.

At the time of going to press, the dotted lines that make up the FTM Parabolic SAR indicator were positioned above its price. This indicator tracks the possible direction and reversal of the trend.

When its dotted lines are above the price of an asset, the market is considered to be in a downtrend.

Furthermore, the coin's MACD indicator returned red histogram bars, as its MACD line was below the signal line and was trending down at the time of this publication.

Since the bearish intersection occurred on March 26, the price of FTM has plummeted by 10%.

Monero [XMR]

According to data from CoinMarketCap, privacy token Monero [XMR] had the third highest weekly loss. During that period, its value plummeted 8%.

XMR was trading at $129.72 at press time, extending its losses by 2.3% in the last 24 hours.