In recent years, the world has witnessed the meteoric rise of cryptocurrencies as a legitimate form of digital currency. However, India has been slow to adopt this trend, and the government is wary of its possible misuse in criminal activities.

Nonetheless, the country has seen a surge in cryptocurrency trading and investment, leading to a number of recent developments, including the Supreme Court-lifted cryptocurrency ban and, since then, the cryptocurrency market in India has witnessed a significant increase in activity.

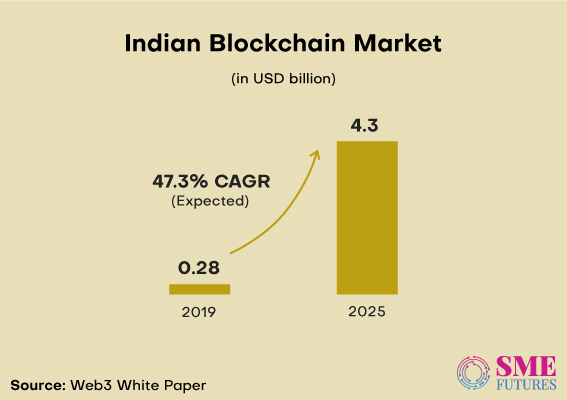

According to a report by Chainalysis, a blockchain analytics firm, India ranks fourth out of the top five countries in the world for the highest cryptocurrency adoption rates, with more than 15 million Indians actively trading or owning assets. digital. Furthermore, the Indian Blockchain market is expected to grow from $280 million in 2019 to $4.3 billion by 2025 at a CAGR of 47.3%, according to a white paper.

This implies that despite strict government regulations, the cryptocurrency market in India is expanding. However, the government has taken another step to make it comply with the law.

The government recently included cryptocurrencies in the Prevention of Money Laundering Act (PMLA), stating that the regulations are necessary to prevent money laundering and other criminal activities, and that the privacy of its users will be protected.

The measure is being well received

There has been excitement in the cryptocurrency space since the announcement of the inclusion of cryptocurrencies and digital assets in the PMLA, and cryptocurrency enthusiasts and entrepreneurs are being very receptive to this move by the government.

“We see this move as a step towards a well-regulated crypto ecosystem,” says Sumit Gupta, co-founder of CoinDCX.

“According to the notification, due diligence and enhanced due diligence are now mandatory for entities such as CoinDCX under the PMLA and VDA service providers are now effectively categorized as reporting entities. This ensures that only strong and transparent players operate in the industry and comply,” he adds.

Speaking to SME Futures, WazirX VP Rajagopal Menon says: “We welcome the new Anti-Money Laundering (AML) reporting notification to the Financial Intelligence Unit (FIU) for crypto assets, which aligns with our existing policies and practices. This is the first of many steps towards regulation and we are committed to complying with all relevant regulations and guidelines."

Opining, Mohammed Roshan, Co-Founder and CEO of GoSats, says: “This is a progressive step for the Indian crypto ecosystem. This move will help strengthen the industry's collective efforts to effectively combat money laundering and other illegal activities."

The PMLA has been used to address the use of cryptocurrency for illegal activities. In 2018, the Enforcement Directorate (ED) conducted raids on several cryptocurrency exchanges, alleging that they were involved in money laundering and terrorist financing. The ED also seized millions of dollars worth of cryptocurrency in these raids.

Speaking of which, KoinX founder Punit Agarwal says, “The rise of crypto and VDA has also led to a rise in issues like money laundering in the space. Due to this, more than Rs. Rs 900 crore was allegedly laundered, which was eventually seized by the PMLA.”

“Due to the presence of bad actors, concerns like custody of assets and their related financial services could very well be avoided under the purview of the Prevention of Money Laundering Act (PMLA),” it adds.

Impact on the Indian crypto ecosystem

Many countries around the world have recognized the potential benefits of cryptocurrencies and have established regulatory frameworks to govern their use.

Also, India, like many other countries in the world, is grappling with the issue of regulating cryptocurrencies. And the PMLA will reshape the country's crypto-economy.

“This means that VDA platforms are now required to perform KYC and monitor and record all transactions and report to the FIU when any suspicious activity is detected,” says Coinswitch's Singhal.

“Such rules are already applicable to banks, financial institutions and some other entities, such as intermediaries such as securities, markets, real estate, etc. And now they've been expanded to cover VDAs as well,” he explains.

Explaining the impact of PMLA listing, KoinX's Agarwal comments: "Businesses and exchanges would now have to strictly perform and report Know Your Transactions (KYT), perform extensive transaction tracking and reporting, address detection, and report any Suspicious Activity Report (SAR) or any Suspicious Transaction Report (STR)”.

Kriti Singh, chief of staff at a public policy think tank, The Dialogue, explains that an individual or group who owns around 10 per cent of the client ownership of a "reporting entity" will be seen as the ultimate beneficial owner in comparison with the previous threshold. 25 percent ownership.

“This means that, along with banks and financial institutions, which are 'reporting entities,' entities dealing with virtual digital assets will be given the same status, allowing the government to track their transactions, including those that are they carry out. India,” he adds.

This move can also help improve the reputation of the crypto industry. Also, more entrepreneurs and investors will get involved, leading to more growth and innovation.

Challenges are on the way

The inclusion of cryptocurrencies in the PMLA also raised concerns among the cryptocurrency community regarding privacy and data protection. Many argue that strict KYC rules and record keeping requirements will infringe on users' privacy and expose them to the risk of data breaches.

Additionally, due to this, compliance costs for crypto businesses could increase as they may need to spend on new technology and new processes to comply with the requirements.

“They could make it difficult for crypto companies to operate globally. Various nations have different AML regulations, and complying with all of them can be challenging,” says WazirX's Menon.

Explaining how this could also lead to increased costs for businesses, KoinX's Agarwal says, “This is because they would have to invest in systems and processes to comply with regulations. It could also make it difficult for some users to access cryptocurrency exchanges if they do not comply with KYC requirements.”

The PMLA will also require cryptocurrency exchanges and other intermediaries to keep records of their transactions and report any suspicious transactions to the FIU. This will further lead to stricter scrutiny of crypto transactions and exchanges, a process that will take place in due course.

However, the government has stated that these regulations are necessary to prevent money laundering and other criminal activities and that the privacy of users will be protected.

Intent behind the PMLA

Crypto transactions are inherently pseudo-anonymous, making it difficult to trace the origin and destination of funds. By placing cryptocurrencies under the purview of the PMLA, the government ensures that companies adhere to strict KYC standards and keep a record of all their transactions, making it easier to identify suspicious behavior and prevent money laundering. .

“The global nature of cryptocurrencies makes effective regulation difficult for any one government. Due to this lack of regulation, criminals could use crypto to transfer funds across borders without detection. By incorporating cryptocurrency exchanges under the PMLA, India is taking an important step towards regulating cryptocurrencies and limiting their misuse,” says WazirX's Menon.

The objective of this law appears to be to safeguard the interests of the country's investors and traders, particularly those who are not very familiar with the ups and downs of the industry.

“This could work well in favor of investors across the country as it contributes to a more secure crypto environment and prevents any misuse of investor money,” notes KoinX's Agarwal.

“The government could provide much-needed clarity on the legal and regulatory environment for cryptocurrencies by placing cryptocurrency companies under the PMLA,” Menon adds.

This government move may improve the overall integrity of the industry and make it a safer place for consumers to invest their money. Therefore, the future of cryptocurrencies and VDAs in India looks bright.

How is the road ahead?

The cryptocurrency market in India has seen significant growth and development in recent years. However, with the lifting of the ban on cryptocurrencies and the inclusion of cryptocurrencies in the PMLA now, the cryptocurrency industry expects even faster growth.

“However, the tax and regulatory battles have not been easy for these new companies. Despite uncertainties and regulatory challenges, there is a growing interest in and demand for cryptocurrency and blockchain technology in the country,” Punit Agarwal says.

The future of crypto startups in India is extremely bright. GoSats' Mohammed Roshan believes that with the right regulations and policies, India has the potential to be a global hub for crypto and become the 'Silicon Valley of Crypto'.

“India has a wealth of talented developers, ample VC capital and other investors interested in investing in India's growth story, and a large young, tech-savvy population, all of which can help make this is a reality”, adds Roshan. .

While Singh from The Dialogue feels that since it is an emerging sector, its regulation is yet to be met due to certain challenges such as money laundering, terrorist financing, cyber security, consumer protection, etc.

“It is pertinent to address these issues and this move is in the right direction to address some of these concerns and will bring more visibility to the government alongside the collective efforts of the industry,” Singh emphasizes.

In conclusion, Indian crypto experts believe that while there are concerns about the use of cryptocurrencies for illegal activities, it is important to recognize its potential benefits. Therefore, the proposed bill is a step in the right direction and is expected to lead to a more comprehensive regulatory framework for cryptocurrencies in India.