-

A crypto whale transferred 12,000 ETH to Binance on Wednesday, according to Lookonchain.

-

Ether rose 11% on Wednesday despite regulatory concerns.

-

The options market remains more bearish on ether than bitcoin.

An investor holding a large amount of ether {{ETH}}, the so-called whale, which began trading the native token of the Ethereum blockchain in 2017, moved a large portion to the Binance cryptocurrency exchange on Wednesday, in a possible precursor to the liquidation of tenure.

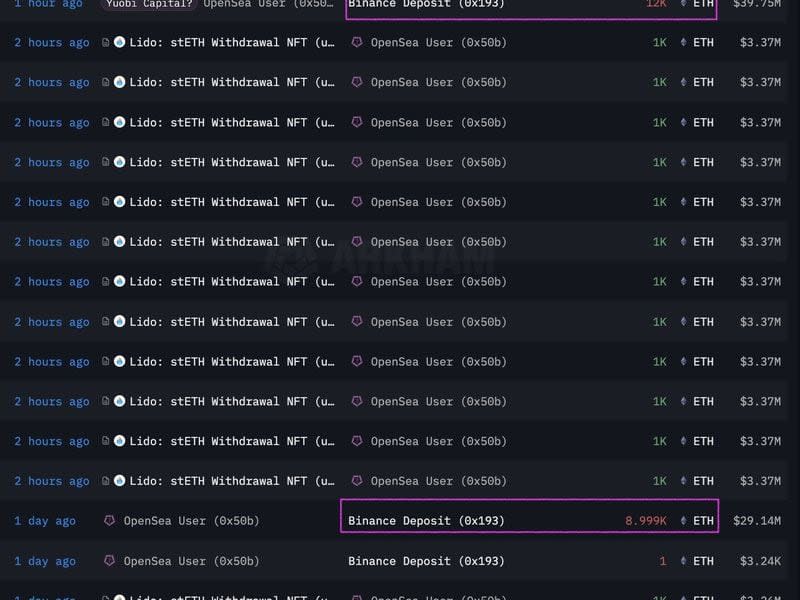

Approximately 18 hours ago, the address x50b42514389F25E1f471C8F03f6f5954df0204b0 transferred 12,000 ETH (worth $42.8 million at the time) to Binance, according to blockchain sleuth Lookonchain. That's about 0.01% of the total circulating supply of the second-largest cryptocurrency by market capitalization. The same address transferred almost 9,000 ETH to Binance on Tuesday, withdrawing 30 million tether (USDT). Tether is the largest dollar-pegged cryptocurrency in the world.

"A giant whale deposited 12K ETH on Binance 1 hour ago and may sell it", Lookonchain published in X during US business hours on Wednesday.

Moving coins to addresses linked to cryptocurrency exchanges often indicates an intention to sell or use coins as margin in derivatives trading. Therefore, a large inflow of coins often heralds greater price volatility.

It is possible that the whale was looking to sell the rising cryptocurrency. Ether rose 11% to $3,500 on Wednesday, reversing Tuesday's decline. At press time, it was trading at $3,535, according to data from CoinDesk.

The rally came even after reports emerged that the U.S. Securities and Exchange Commission is trying to classify ETH as securitya move that would derail plans to list spot ether exchange-traded funds in the country and subject ETH and projects that interact with Ethereum to stricter regulation.

Still, Deribit options market data shows that traders are more bearish on ether than bitcoin {{BTC}}. While ether one-week puts trade at a 4% premium over its calls, bitcoin puts trade at a 2% premium. A similar dynamic is seen in options that expire within a month, according to data tracked by Amberdata.

A put option gives the buyer the right, but not the obligation, to sell the underlying asset at a predetermined price on or before a specific date. A put buyer is implicitly bearish on the market and seeks to profit or protect against an imminent price drop.