U.S. stocks capped a wild 2023 with a two-month run that has taken the Dow Jones to all-time highs and the S&P 500 index within striking distance of a similar milestone.

But after such a powerful rally, some portfolio managers and strategists worry that the market could suffer its own post-New Year's Eve hangover once the calendar turns to January 2024.

Rather than providing a tailwind for the market, several who spoke to MarketWatch worried that the “January effect” could work in reverse, as investors scramble to lock in profits after the S&P 500 rose. 24% in 2023, according to FactSet data.

"Any time you have a big breakout like that, I think you're vulnerable to some profit taking," James St. Aubin, chief investment strategist at Sierra Investment Management, said during an interview with MarketWatch. "It wouldn't surprise anyone to see the market cool off a little after a good run."

From lofty valuations to bullish sentiment indicators, economic data, geopolitics and more, here are some things that could trip up the market in January.

US Stocks Are Already Overbought

A technical indicator closely followed by portfolio managers and technical analysts on Wall Street has been screaming that US stocks are overbought for a month.

The S&P 500's 14-day Relative Strength Index, a momentum indicator that's supposed to help put into context the magnitude of the index's latest moves, rose as high as 82.4 on Dec. 19, its highest level since 2020. , according to FactSet data.

DATA

Although the RSI has since retreated, it continues to hover around 70, a level that analysts consider to be the threshold at which something can be considered "overbought."

Sentiment has gone from extremely bearish to extremely bullish.

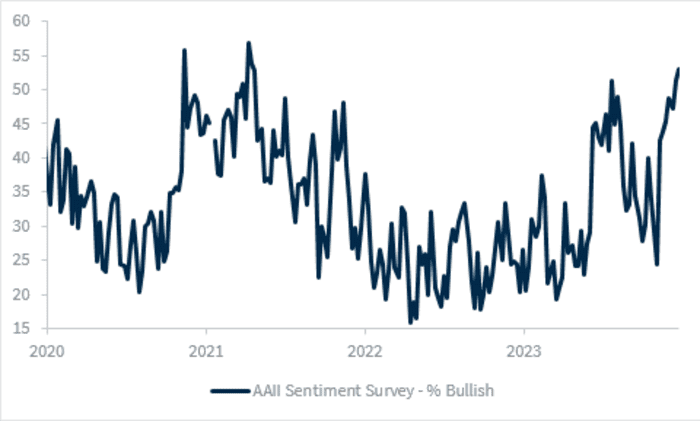

In the span of just two months, investors have gone from incredibly bearish to incredibly bullish, according to the American Association of Individual Investors' weekly sentiment survey.

This should give investors pause, as the indicator is considered a reliable counter-indicator. When sentiment stretches in either direction, it can indicate that the market is about to turn. Investors say that's what happened in July, and also in October, after the S&P 500 hit its bear market bottom in 2022.

RAYMOND JAMES

According to the AAII survey released before the Christmas holidays, nearly 53% of respondents said they were optimistic, the highest number since April 2021. That number dropped slightly this week, but remains high relative to levels October.

The VIX is extremely low

Wall Street's favorite “fear meter” is giving the thumbs up. For some, that's reason enough to worry.

The Cboe Volatility Index

VIX,

Better known as Vix, it measures implied volatility, or how volatile traders expect the S&P 500 to be over the next month based on trading activity in options contracts linked to the index.

In December, the Vix fell below 12 for the first time since before the COVID-19 pandemic hit.

Nancy Tengler, CEO and CIO of Laffer Tengler Investments, said in an emailed comment that she is following the Vix closely. Once volatility starts to increase, investors should consider taking some chips off the table.

Inflation progress could stall in January

Some investors are already looking forward to the next US inflation report, due out on January 11.

The Cleveland Fed immediate inflation The core CPI rose more than 0.3% in December. If this proves accurate, it would be the highest inflation reading since May.

And even if core inflation slows a little, stocks may not greet it with the same enthusiasm they have shown in the past.

“It is to be expected that the US CPI for December will continue to show a disinflationary trend, although the question is: can we continue to rebound with the same dynamics?” said Larry Adam, chief investment officer at Raymond James, in emailed comments.

Earnings season could disappoint

For three consecutive quarters, starting with the last three months of 2022, the largest US companies saw their profits shrink year over year.

This “earnings recession” finally came to an end in the third quarter, but the conundrum now facing investors is whether companies will be able to meet Wall Street's lofty expectations for 2024.

The rise of artificial intelligence software and the fact that the U.S. economy avoided a recession in 2023 has helped boost analyst confidence about earnings, strategists said.

According to FactSet's rising consensus estimate, analysts expect aggregate S&P 500 earnings to rise 11.7% by calendar year 2024.

“Markets have been cooking up this 11.7% earnings growth figure for some time now. That's a lot of optimism,” Goldman said during an interview with MarketWatch.

And that's not all…

This list is certainly not exhaustive.

Politics and geopolitics also came up a lot in conversations with analysts. Investment professionals cited Taiwan's upcoming presidential election, another looming showdown over the federal debt ceiling in the US, the start of the 2024 Republican presidential primaries, ongoing conflicts in Gaza and Ukraine, and more. , as potential threats to market calm.

Some expressed concern that the Treasury could trigger a sell-off in bonds and stocks with its upcoming quarterly refund announcement in early 2024.

But in Cetera's Goldman's view, a dynamic that Wall Street traders call “buy the rumor, sell the news” could pose a bigger threat.

The reasoning works like this: Investors have already anticipated aggressive interest rate cuts from the Federal Reserve. Therefore, if the Federal Reserve delivers, the rush to profit could drive down stocks rather than propelling major U.S. indexes to new highs. Put another way, many strategists believe investors have already priced in fairly aggressive rate cuts from the Federal Reserve.

So unless the central bank finds a way to deliver something even bigger than Wall Street expects, the major U.S. stock indexes could struggle to continue their advance.

"Markets are already buying the rumor that we're going to have a better 2024, that the Fed is going to cut rates, that breadth is going to widen," Goldman said.

"Maybe we're already seeing it reflected in the price."