Now that the stock market has recently reached new all-time highs, there are many stocks that I am concerned about because they are well valued. While they may eventually reach those valuations, I'm looking for stocks that are still reasonably priced and could benefit from multiple expansion.

Three that come to mind are Amazon (NASDAQ:AMZN), Metaplatforms (NASDAQ: META)and Free market (NASDAQ: MELI). All three companies are still reasonably priced and I think they are solid buys now.

1. Amazon

Amazon is much more than an e-commerce store. It is becoming more of a services-driven business, where its outside sales, advertising, subscription and cloud computing services provide a large portion of its revenue.

This has increased its margins across the board as its service divisions have grown to become a larger part of the company.

With its gross margin hitting all-time highs and its operating and profit margins not far behind, Amazon's transition from a marginally profitable company to a highly profitable one is becoming a reality. While this chart doesn't include the fourth quarter numbers, they were phenomenal, with gross, operating, and profit margins of 17.2%, 7.8%, and 6.2% respectively.

However, when a company's margins increase, its valuation should also increase. This is because the company can make more profit from each dollar it brings in, which is why software companies have much higher valuations than retailers.

But even though Amazon's gross margins have nearly doubled since 2017, it is valued at the same level.

This doesn't make sense, and with another year of strong earnings growth, don't be surprised if Amazon stock gains a higher valuation later this year.

2. Metaplatforms

Meta Platforms (probably better known by its previous name, Facebook) has many investments in the metaverse and augmented and mixed reality space, but remains primarily an advertising company.

And it's a tough industry because advertising budgets are slashed if a company believes a recession is coming. This affected Meta in late 2022 and 2023, but the advertising market recovered along with increased optimism.

In the fourth quarter, Meta's advertising revenue grew 24% to $38.7 billion, a new all-time high. This strength is expected to continue in the first quarter, with management estimating total revenue to be $35.8 billion, for growth of 22%.

And because Meta is now optimized for profit, your Earnings per share (EPS) should soar higherwhich makes the stock look cheaper in terms of price-to-earnings (P/E) ratio.

So while Meta may look expensive from a P/E standpoint (30 times earnings), its forward P/E (which uses analyst projections for the next 12 months) is a bit cheaper, at 26 times earnings . As the advertising market continues to strengthen, this will boost the business and bring its share price down with it. As a result, Meta looks like a great buy now.

3. MercadoLibre

MercadoLibre has a similar history to Amazon, which makes sense: many call it the "Amazon of Latin America." While this is true for one aspect of the business (MercadoLibre has a dominant e-commerce store and shipping logistics division), that description leaves the company short. What Amazon has and does not have is a fintech and consumer credit division.

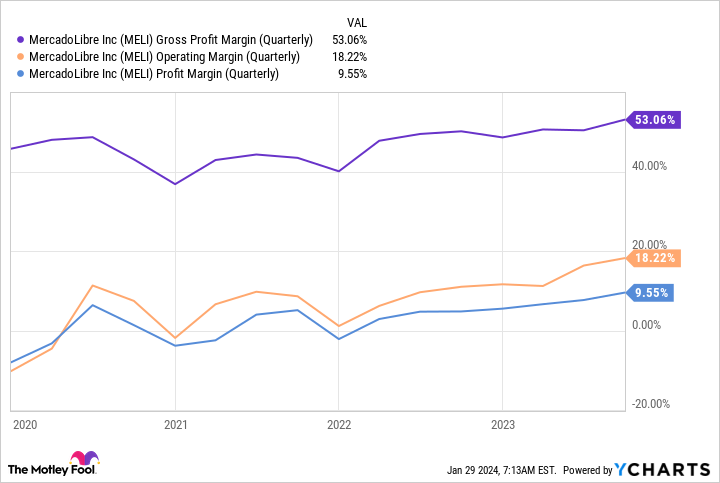

With over 40% of revenue coming from fintech, it is a well-balanced company. And like Amazon, MercadoLibre has dramatically improved its margins.

While its gross margin has remained fairly stable, its operating and profit margins have expanded significantly. In the third quarter, its operating margin increased 7.2 percentage points to 18.2%, and its profit margin increased 4.7 percentage points to 9.5%.

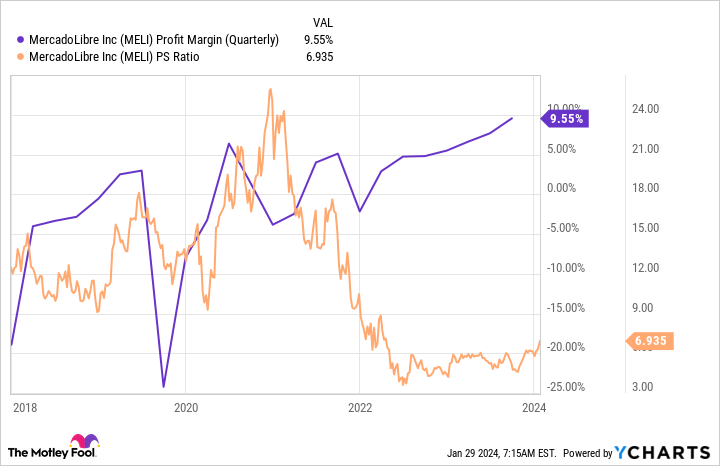

Despite this increase, MercadoLibre is trading at levels not seen in more than a decade.

As a result, I think MercadoLibre is a fantastic buy here. as its share price appears undervalued compared to historical trends.

Should you invest $1,000 in Amazon right now?

Before you buy shares in Amazon, consider this:

He Varied and Dumb Stock Advisor The analyst team has just identified what they believe are the 10 best stocks for investors to buy now... and Amazon was not one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow success plan, including guidance on how to build a portfolio, regular analyst updates, and two new stock picks each month. He Stock Advisor The service has more than tripled the performance of the S&P 500 since 2002*.

*Stock Advisor returns from January 22, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Keith Drury It has positions in Amazon, MercadoLibre and Meta Platforms. The Motley Fool has positions and recommends Amazon, MercadoLibre and Meta Platforms. The Motley Fool has a disclosure policy.

The stock market just hit a new all-time high. Here are 3 amazing stocks I'm still buying. was originally published by The Motley Fool