There is no doubt that the bipartisan approval of the Financial Innovation and Technology Act for the 21st Century (FIT21) is a monumental advance for the US crypto industry, bringing much-needed regulatory clarity into view. However, despite its good intentions, FIT21 is fundamentally flawed from a market structure perspective and introduces issues that could have far-reaching unintended consequences if not addressed in future Senate negotiations.

Joshua Riezman is deputy general counsel at GSR.

Note: The opinions expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates.

One of the most problematic aspects of the bill is the creation of a forked market for crypto tokens. By distinguishing between “restricted digital assets” and “digital commodities” in parallel trading markets, the bill sets the stage for a fragmented landscape that fails to accommodate the inherently global and fungible nature of crypto tokens and creates the first of its kind. guy. friendly compliance complications.

This legislative initiative arises from long-standing debates over the application of US federal securities laws to cryptographic tokens and the difference between bitcoin, considered a non-security, and almost all other tokens. The US Securities and Exchange Commission's (SEC) guidance on whether a crypto token is a security has generally been based on whether the associated blockchain project is "sufficiently decentralized" and therefore not a " value" of an investment contract as defined by the Howey test.

FIT21 attempts to codify this impractical test by dividing regulatory oversight of crypto spot markets between the Commodity Futures Trading Commission (CFTC) and the SEC, based, among other things, on the degree of decentralization.

While the bill appears to helpfully clarify that cryptographic tokens transferred or sold pursuant to an investment contract do not inherently become securities themselves, it unfortunately contradicts itself by granting the SEC full authority over such contract assets. investment when sold to investors (or issued to developers). ) during the period of time before a project reaches decentralized Valhalla. Only tokens airdropped or obtained by end users are initially “digital products” subject to the jurisdiction of the CFTC.

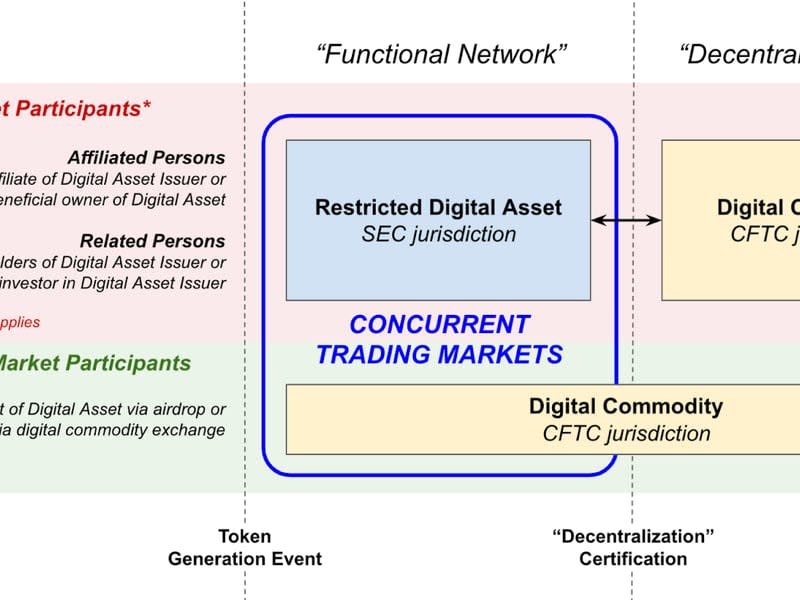

Most confusingly, FIT21 allows simultaneous trading of restricted digital assets and restricted digital products for the same token in separate and distinct markets during this period (as shown in the following graph). It is likely that many projects never They meet the bill's prescriptive definition of decentralization and therefore trade in disjointed markets in the US indefinitely.

The bill's proposed bifurcated market for restricted and unrestricted digital assets ignores fungibility as a fundamental feature of crypto tokens. By creating categories of restricted and unrestricted assets, the bill disrupts this principle, creating confusion and market fragmentation. This could harm liquidity, complicate transactions and risk management mechanisms such as derivatives, reduce the overall utility of crypto tokens, and ultimately stifle innovation in a nascent industry.

See also: The Financial Innovation and Technology Act for the 21st Century is a defining moment | Opinion

Implementing such distinctions would likely require technological modifications to crypto tokens to allow buyers to know what type of crypto asset they are receiving, so that they can meet specific market requirements. Imposing such technological markup on restricted digital assets, even if possible, would create a “US-only” crypto market separate from global digital asset markets, reducing the utility and value of each relevant project.

To protect customers and ensure the smooth functioning of US digital asset markets, lawmakers must refine the bill to unify spot markets.

As shown in the chart above, tokens may move back and forth between the SEC and CFTC markets in case decentralized projects become centralized again. The complexity and compliance costs created by such a scheme applied to thousands of future crypto tokens are dramatically underestimated and would undermine the credibility and predictability of US financial markets. There are very few examples of financial products transitioning between the jurisdiction of the SEC and CFTC and it is almost always a tire fire (e.gthe transition in 2020 of KOSPI 200 futures contracts from CFTC jurisdiction to joint CFTC/SEC jurisdiction).

The bill further underestimates the international nature of crypto token markets. Crypto tokens are global assets that are traded as the same instrument globally. Attempting to restrict certain assets within the US would likely lead to regulatory arbitrage, where flow back from international markets would undermine the intent of the bill and erode the competitiveness of the US crypto industry.

Developers and investors outside the US are unlikely to self-impose similar restrictions on restricted digital assets. New projects and investors will therefore be incentivized to move development and investment outside of the US to avoid these requirements. This would make it extremely difficult to prevent the US digital goods market from being flooded with non-US tokens that would have been restricted digital assets if they had been "issued" in the US.

Finally, and ironically, the bill designed to protect American consumers could end up hurting them due to poor market structure. The initial CFTC-regulated markets for end users will be filled with sellers who typically received tokens for free. These unbalanced market dynamics will likely lead to low prices and higher volatility compared to restricted and international markets, benefiting professional arbitrageurs at the expense of US retail trading.

See also: Is House Bill FIT21 Really the Legislation Cryptocurrencies Need? | Opinion

This system will be further manipulated by insiders and professional investors as arbitrageurs take advantage of disjointed prices and price jump discontinuities caused by the transition between centralized and decentralized designations. At best, US retail markets will be a noisy signal of fundamental value and end users will be the last to receive institutional liquidity.

While FIT21 is a crucial step in addressing the regulatory challenges posed by crypto tokens, its current proposed market structure could have unintended consequences. To protect customers and ensure the smooth functioning of US digital asset markets, lawmakers should refine the bill to unify spot markets for fungible crypto tokens that would otherwise not be securities into one framework. coherent regulatory.