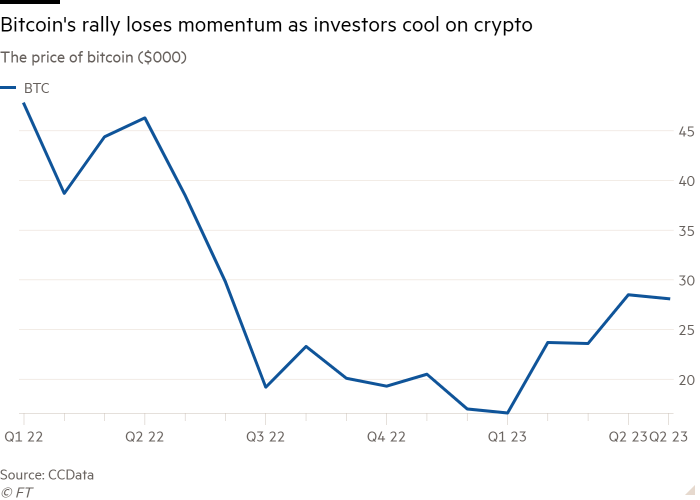

Cryptocurrency trading activity has slowed even as bitcoin enjoys its longest winning streak in more than two years, in a sign that many investors are increasingly reluctant to buy on the rebound after a series of crashes and scandals in 2022. .

The price of bitcoin, the most popular token, has risen 70 percent this year, helping the market regain some momentum after the failure of companies like the FTX exchange.

Investors have shrugged off lawsuits by US regulators against companies including Binance, the industry's largest exchange, and crashing stablecoin operator Terraform Labs as authorities have tried to crack down crack down on activity they consider illegal.

However, the bitcoin price has since been stagnant for more than a month, trading in a tight range around $28,000. That pause has been accompanied by reduced volumes, with small operations increasingly able to move market prices.

"While bitcoin's recent performance is excellent at first glance, many in crypto are calling this year an unwanted rally," said Charles Storry, head of growth at Phuture, a crypto index provider.

“Sentiment hasn't changed, and regulatory scrutiny is sidelining a lot of new money that could otherwise enter the space. Price movements don't mean much if the industry isn't making significant progress in regaining confidence and attracting new investors,” he added.

A forceful 2022 has left investors with losses or funds stuck in limbo as failed cryptocurrency lenders and exchanges go through bankruptcy proceedings in court.

Cryptocurrency enthusiasts also argued that confidence has been renewed by the weakness of the global banking sector and the large outflow of deposits from banks such as the US. Silicon Valley Bank and Silvergate, and Credit Suisse in Switzerland.

Digital Asset Dashboard

“That rally we experienced after the banking crisis earlier this year seemed to be directly related to a flight from the dollar for safety and self-custody of funds,” said Edmond Goh, head of trading at cryptocurrency broker B2C2.

But that sentiment has been undermined by a series of signals coming from the crypto markets. Analysts note that the rally in cryptocurrency prices was already based on a lightly traded market.

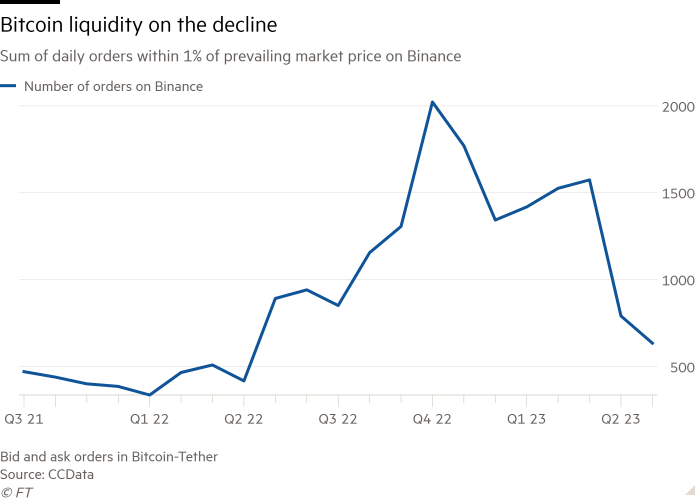

The degree to which a market can absorb large orders without major changes in the bitcoin price has decreased since the beginning of the year, according to data provider CCData.

In January it would have required the purchase of more than 1,400 bitcoins, roughly the equivalent of $23 million at the time, to move the token's price by more than 1 percent from its current market value, CCData said.

Towards the end of last month, it would have taken just 462 bitcoins, worth about $13 million, to move market prices by 1 percent, the lowest point of market depth for the bitcoin-tether trading pair. since May 2022, when the industry plunged into crisis.

“Prices are recovering, but liquidity has not returned yet. No exchange or market maker has yet to fill the space that FTX and [its sister trading arm] Alameda was once listed,” said Michael Safai, managing partner at cryptocurrency trading firm Dexterity Capital.

Investors who have bought bitcoins in recent months are now holding on to their investments.

Glassnode, a crypto data provider, said "there has been remarkably low spending" by investors buying bitcoin when it hit a two-year low after FTX's bankruptcy last November.

“The 'FOMO' that drove many institutional and retail investors for the first time last year is obviously not happening now, even though the crypto markets have rallied significantly this year,” said a Dubai-based crypto fund manager, referring to to a fear of missing out

Additionally, there have been outflows of $72 million in the past two weeks in digital asset investments, ending a six-week streak of consecutive inflows, according to CoinShares. The crypto investment group attributed the trend to the likelihood of further interest rate hikes by the US Federal Reserve.

Traders are also concerned that the heavy clouds that have overshadowed the industry for the past 12 months have not completely lifted. Binance, the world's largest crypto exchange, is likely to be embroiled in a protracted lawsuit with the Securities and Exchange Commission.

Another cloud is the fate of Genesis, one of the largest lenders in the crypto market, which filed for bankruptcy in January due to over $3 billion after the FTX implosion.

Owner Digital Currency Group, one of the world's largest bitcoin owners through its asset management division, is seeking to raise funds to pay off Genesis creditors. DCG said last week some Genesis creditors had walked away from a previously agreed restructuring deal.

The market appears to be "in a holding pattern pending the resolution of DCG's debt payments," said Ram Ahluwalia, chief executive of investment adviser Lumida Wealth Management.

The uncertainty, coupled with the crisis in the US regional banking industry, has underlined for many that the market is still working through many of its problems.

“There is not a lot of organic momentum behind cryptocurrencies yet,” Safai said. “Major events that drive cryptocurrency prices past trouble spots. . They are few and far between."